Mar 5, 2019 07:03 UTC

| Updated:

Mar 5, 2019 at 08:51 UTC

2019, Are ICOs Making a Comeback?

The number of ICOs in February-2019 observed an impressive growth of more than 100% when compared to the previous month and raised a whopping $256 million (Source). This comes at a time when the crypto space is in the doldrums, as regulators in major countries like the USA and China cracked down on ICOs and imposed stringent rules on public token offerings. On top of this, the need for a regulatory compliant token offering has fueled the rise of security tokens, and the market seems to sway in favor of it.

With the odds stacked against it, what chances does the ICO have of rejuvenating itself in the crypto space? And, could these developments herald the comeback of ICOs? Let’s look at some key developments that occurred this month.

ICOs Are Gaining Ground in Some Countries

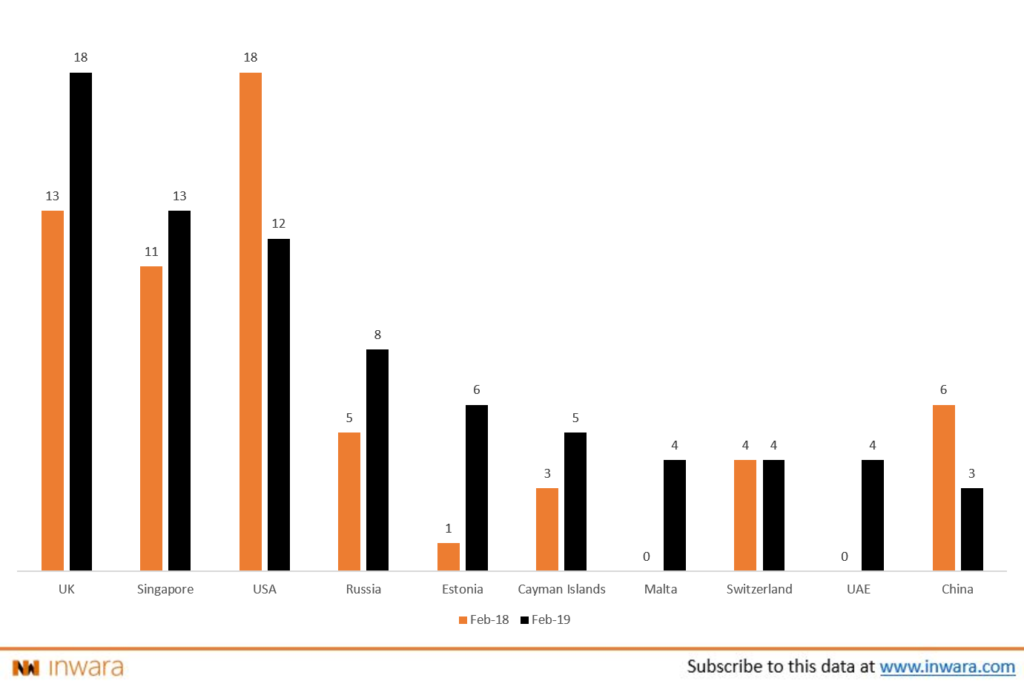

UK and Singapore have seen a spurt in the number of Initial Coin Offerings, while the numbers have tapered in countries like the US. An analysis of this month’s ICO numbers data provides conclusive evidence of this statement.

“In February-2019 alone, the number of ICOs in the USA declined by as much as 33% while in the UK and Singapore the numbers grew by as much as 38% and 18% respectively when compared against February 2018.”

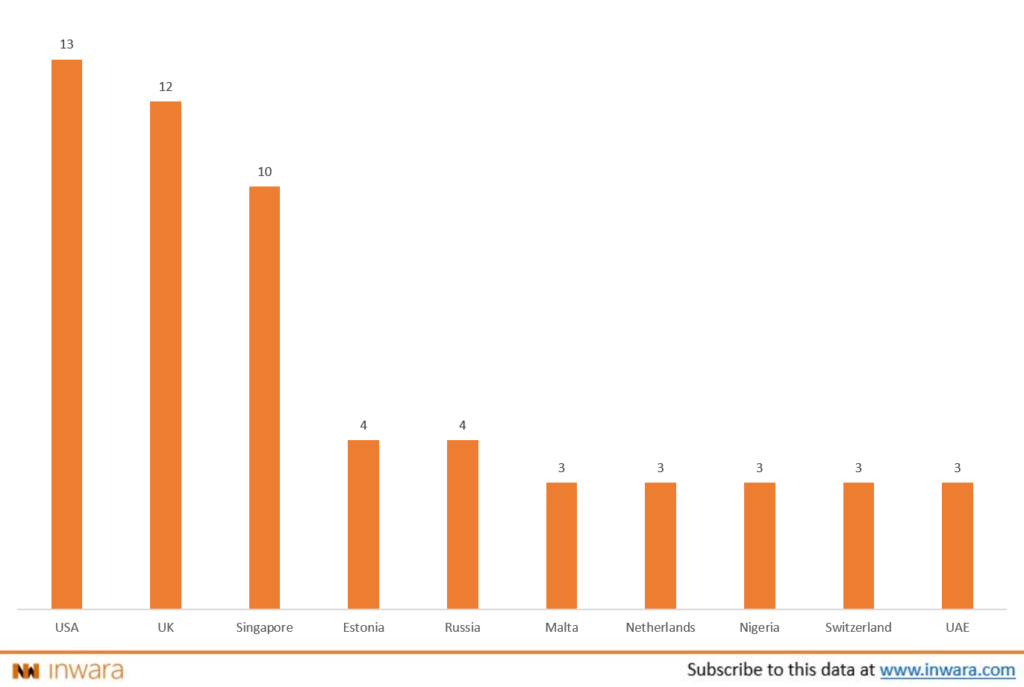

ICOs in February-19, Country-wise

Countries like Estonia, Malta and the UAE, witnessed impressive growth this month. Estonia observed the highest growth at 500%, closely followed by emerging players like Malta and the UAE. This incredible growth is likely due to the governments of these countries encouraging the use of cryptocurrencies and blockchain technology to boost their own economies by attracting businesses. Estonia & Malta are fast becoming crypto havens given the tax and legal norms allowing for conducive business environments.

The benign attitude of these governments also becomes clear when considering ICO sales restrictions of this month. During the launch of an Initial Coin Offering, retail and private investors buy digital tokens of a specific company in hopes of getting a return on investment when the company releases its product/service. Often companies launch ICOs on a global platform to attract a broader spectrum of investors but sometimes these ICOs restrict investors from certain countries from participating in the token offerings, this is monikered as ICO sale restrictions.

ICO Sales Restrictions in February-19, Country-wise

“In countries like the USA, the number of ICO sales restrictions were over 300% higher than in emerging markets like the UAE or Malta. This is likely because these countries provide a more favorable environment for these ICOs to succeed, which will drive more companies to launch ICOs in these countries.”

Can ICOs Bounce Back?

To answer this question, we need the answer to “Why have regulatory authorities, like the SEC, cracked down on ICOs in the first place?” This is largely due to the numerous ICO scams that unravelled over the past year – over 875 ICOs – that prompted regulatory authorities to take action against ICOs to protect investors.

Ironically, the lack of a clear regulatory framework was the reason for the meteoric rise of ICOs, and it inadvertently caused its dramatic downfall as well. But could emergent players in the space like UAE and Malta, with the earlier experience, create a favorable ecosystem for digital asset adoption & proliferation? Sure looks that way, only time will tell!