Mar 13, 2020 11:05 UTC

| Updated:

Mar 13, 2020 at 11:05 UTC

Rise in trading volume a positive sign for cryptocurrency

It is very important to understand all the metrics that are involved in evaluating the investment potential of a particular cryptocurrency. There are various basic and important terms that are related with everyday trading of various cryptocurrencies, the terms being volume , market cap and supply.

Today we are going to emphasise more on the volume, that is trading volume, because trading volume can make or break your trades. It is very important to know when to pass on an investment that doesn’t seem to be of good use in future.

Trading volume

Trading volume is the amount of activity that is surrounding a coin or a token. The volume will allow you to see how popular an asset is and how frequently it is being shuffled among its users. The ledger that is generated by the buying and selling activity surrounding each coin or token, can be very useful for planning your trades.

Investors should keep in mind that this is only the publicly traded volume and it is possible that large sums of cryptocurrency are being traded privately through OTC markets, and what is shown is not the entire market.

The volume of a token that is listed on CoinMarketCap is quite simple to understand. It is the amount of the coin that has been traded in the last 24 hours. For example, roughly $3.5 billion worth of Bitcoin has changed hands in the last day. You can break this down in various ways; you could also list it as 3,039,787,668 Euros. Or, in crypto terms, 642,566 Bitcoins.

You can also slice and dice it by exchange. In the last 24 hours,

XBOND.IO a full-featured spot trading platform for major digital assets & cryptocurrencies, including Bitcoin, Ethereum, EOS, Litecoin, Ripple, NEO, Monero and many more, experienced a surge in Trading Volumes within the exchange.

XBOND offers a variety of trading platforms from Web Based, Mobile to Desktop Platform, XBOND will also launch its P2P Platform XBONDP2P.COM in March 2020 to facilitate P2P transactions in the market which is presently turbo charged with enthusiasm and also with the lifting of curbs on the cryptocurrency trading in India, this news has sent a positive wave of emotions in the global trading community as well.

Essentially, volume underscores how many people are buying and selling the coin. If the price of Bitcoin goes up and it shows a hefty volume, that tells us lots of people are making moves. Thus, it will likely keep going up. If the price of Bitcoin drops, but there’s minimal volume, that could tell us only a small amount of people back the trend. Let’s go into more detail on the ramifications.

Arguably trading volume is the most important metric because of the sole reason it can be broken down into various ways. From volume, you can infer the direction and movements of a coin. It’s an essential metric for traders. Volume can be examined in minute detail. You can track volume on CoinMarketCap by the last 24 hours, last week, or last 30 days. This helps reveal if a coin’s recent swings are an aberration or the norm. A coin with frequent heavy movements won’t attract attention if it has high volume. If a coin normally has less volume, heavy trading in the last 24 hours could indicate there’s some support behind the move it may be making.

“Despite cryptocurrencies having fallen off their record highs, the sector is expected to experience double-digit growth in trading volumes next year suggesting that trader enthusiasm in the nascent asset class has not waned, crypto trading volume will grow…”

– words from Anurag Singh, CEO of Xbond.io

You can also examine which exchanges had what volume. This matters because exchanges frequently have different prices. As well, many exchanges are geographically-focused. Kraken, for instance, is largely a European exchange. OKCoin functioned in China until the People’s Bank of China cracked down recently. Volume by exchange can reveal where the buyers or sellers of a coin are. CoinMarketCap does not, however, reflect exchanges with no fees. Exchanges that don’t charge a fee allow traders and bots to send coins back and forth for free, imitating a high volume.

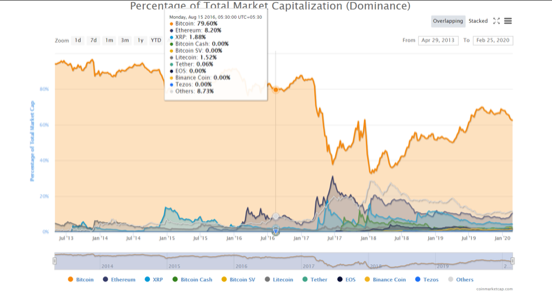

When you closely observe the trends that are generated over a period of time considering all the metrics such as volume and other. It can be clearly observed that the coins with the biggest popularity are traded the most. When you go on CoinMarketCap and observe the data generated what you’re going to see is crucial informatin; for example just by studying the snippet below (which is from coinmarketcap) what can be observed in this trend is whenever the prices of Bitcoin surges the price of ethereum goes down and vica versa. Like everything, trading also has its own pattern and after observing them closely and by taking in mind all the metrics, viable information can be derived that would help one in making profits a nd predicting future trends.

With the constant increase in the trade volume of cryptocurrencies. It is very much evident that people are getting more and more involved in the transactions regarding these cryptocurrencies, which is obviously a very good indicator because the more the hands are exchanged with these cryptocurrencies, more is the volume of total transaction going to increase. Which would clearly indicate that more and more people are getting involved.