Nov 16, 2018 13:52 UTC

| Updated:

Nov 16, 2018 at 13:52 UTC

Ether under Negative Events Pressure – Ethereum Price Analysis

Ether continues falling in Nov 16, balancing around $180.95, right near its Sep 2018 lows. With the negative market trends, the crypto may well make new lows very soon, says Dmitriy Gurkovsky, Chief Analyst at RoboForex.

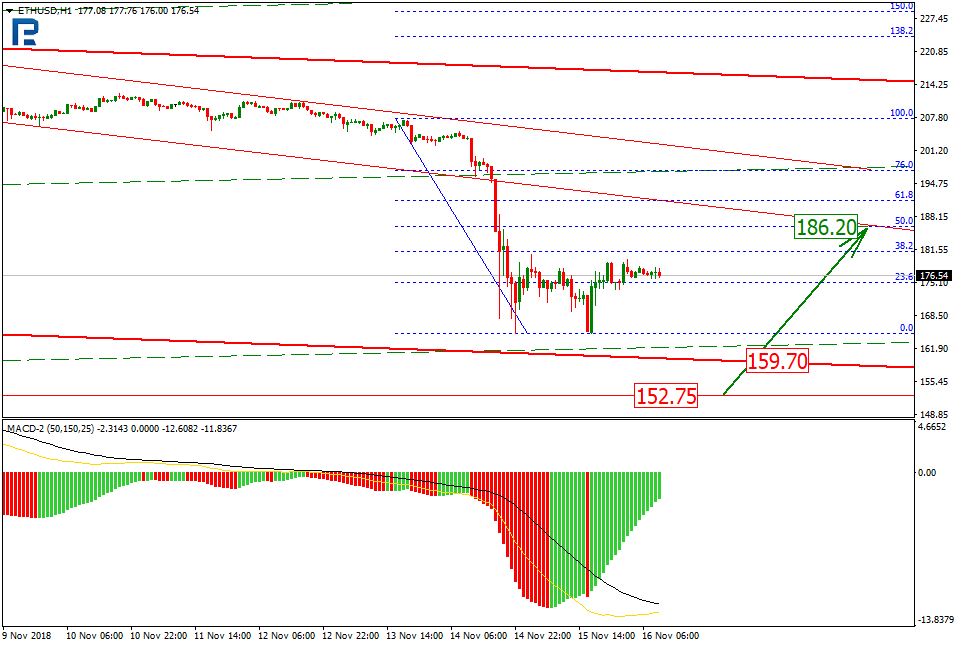

After a massive fall Ether continued following the long term descending trend. The price is close to the major support, while the target is at $159.70. Currently, the price is correcting in the long term, going slightly up. The correction reached 38.20% Fibo and may then hit 50%. It may stop at $159.70, after which the downtrend is likely to continue. $152.75 meanwhile may act as a pivot point, followed by midterm correction towards the resistance at $186.20.

Meanwhile, at Susquehanna, they believe Ether mining is no longer profitable at all. This fall, the mining yield went to its lows first and then even reached zero. This will of course mean few new miners will appear in the market. The reason is quite simple: Ether is cheap, in line with the overall crypto market trends. Last year, Ether mining with RX570, GTX1070 and other similar GPU’s yielded at least $30 per month, while in June 2017 it was up to $150. Now it’s zero.

Another news in focus is Kik refusing to work with Buterin’s platform, which is moderately negative. Ethereum lacks scalability, and so the messenger developers opted for Stellar. Earlier this year, Kik was based on both platform in order to take all the advantages, like Ethereum’s security and Stellar’s speed. Now, however, Kik decided to drop that approach and stop using ECR-20 tokens, migrating the platform to a new kind of blockchain.

Ethereum devs are trying hard to solve the scalability issue. The crypto project that will be first to succeed in it is sure to become a leader for the next few years.

Disclaimer

Any predictions contained herein are based on the authors’; particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.